Upcoming Career Networking Event

HOW TO FAST TRACK YOUR INCOME AND CAREER AS A FINANCIAL CONSULTANT

Discover the “V-Pulse Formula” that has accelerated the income and career progression of over 230 consultants who made the switch from banking, tied agencies, and other professions.

REQUEST AN INVITATION

Featured on:

What you’ll discover at the Vision Advisory Career Networking Event:

How to position yourself to catch “The Wave of Ultra-Rich” transferring their wealth and families regionally to Singapore.

How some of our consultants in their 30s take home 7-figure pay cheques with less than 10 cases a year dealing with high net-worth clients.

Why staying ahead of “The Rise of Fintech and AI” will prevent you from becoming an irrelevant and broke financial consultant.

Live demo: How our proprietary fintech mobile app generated 9,000 high quality leads and hundreds more each month, saving consultants from wasting time and resources on outdated sales tactics.

When can you expect to replace and exceed your current income as a banker, existing consultant or mid-career switcher? Hear the full story from both rookies and top producers who have joined us.

“The New Way” of making clients flock to you, while positioning yourself as an expert instead of being treated like a pesky salesperson.

How the “Advisory Gap” faced by working adults today presents a golden opportunity for you to build deep relationships and turn them into clients even if they already have their own consultants.

How to fight off “The Illusion of Abundance” that causes some consultants to experience a decline in income from their 3rd year in the industry.

Get rewarded in proportion to your capability, instead of a corporate structure where income/career progression is neither transparent nor straightforward.

Have autonomy in how you conduct your practice and pick the clients you work with, as a Modern Entrepreneur-Consultant with Vision Advisory.

Must-have digital tools, strategies and support systems so that you minimise time spent on unproductive paperwork as your clientele expands.

Sneak peek of monthly, quarterly and annual incentives: bonus remuneration, travel perks, retreats, recreational activities and other forms of recognition.

Curious about your career outlook for 2023? Hear from feng shui expert and guest speaker Richard Tan from Xuan Long Consultancy

Wednesday, 25 October 2023

VisionCrest Commercial, Level 3

103 Penang Road, Singapore 238467

3:00pm – 5:00pm

Nearest MRT Station: Dhoby Ghaut

ENTER YOUR CONTACT INFO BELOW TO RESERVE YOUR SPOT:

Due to industry regulations, this opportunity is only open to Singaporeans or PRs aged 21 and above, with at least an A-level or diploma certification.

WHO IS THIS CAREER NETWORKING EVENT FOR?

If you’re a banker, an existing financial consultant, insurance agent, a mid-career professional wondering what’s next for your career, or contemplating a switch, this is for you.

If ever-increasing targets is causing you anxiety… And you’re constantly justifying your worth at work, this event is for you. Own a career where you set your own targets and your own pace. When you’re ready to raise your standards, we have the support and resources ready to go. Steal a sneak peek at our event.

Do you live each day with a sense of guilt for missing out on your kids’ childhood and enduring friction with your partner for not pulling your weight at home? If you long for more control over how you perform your duties at work instead of being subject to company-mandated extra training, micromanagement, overtime, and other penalties. Come to this event and hear our rookies and leaders share their journey.

For the bankers, do you often feel sandwiched between doing enough to meet the bank’s targets, taking blame and managing the client’s emotions when their investments go south? What if we show you a way where everybody’s interests are aligned?

Do you get the sense that the higher you climb in a multinational corporation, the more vulnerable you are during a restructuring exercise? No matter if you are a management trainee, the star member of the team, or even the CEO, in the corporate world, you are but a small (overworked and underpaid) cog in a large machine.The best time to start exploring your options, is before you need them.

Is your work is so intense that you cannot afford to shut down otherwise you will lose track? At our event, we can show you a financially rewarding yet manageable career, where you can easily take breaks and return without feeling overwhelmed by backlog. In fact, most of our team members regularly take at least 3 vacations a year without losing momentum when they return.

Are your income and career path determined by the people above you, who hand out promotions based on their whims and fancies — the recipe for lack of job satisfaction? Instead, you want a career with transparent progression criteria. Where you are fairly compensated for your contribution. Where you can set your goals, instead of having your goals handed to you. Come find out how our consultants are already living the life you want.

REQUEST AN INVITATION

Financial Advisory Ticks All The Boxes

You have ownership over your career.

What you earn is proportionate to the work you put in.

You set your own goals and direction instead of having them dictated by your superiors.

BUT WAIT

With hundreds of financial advisory firms and over 20,000 financial consultants already in Singapore, the industry can be brutal when you’re starting out. How do you maximise your chances of replacing or exceeding your current income within your first 2 years without getting side-lined by the competition?

If you are already in the financial services space but have become stagnant, you likely lack something.

Or perhaps you’re in the midst of deciding which leader to join, but are missing a clear mental checklist to help you make a decision you wouldn’t regret later.

You don’t want to just trade your current misery in for a new set of misery you’re not prepared to deal with.

Find the enlightenment you seek at this upcoming career networking event.

REQUEST AN INVITATION

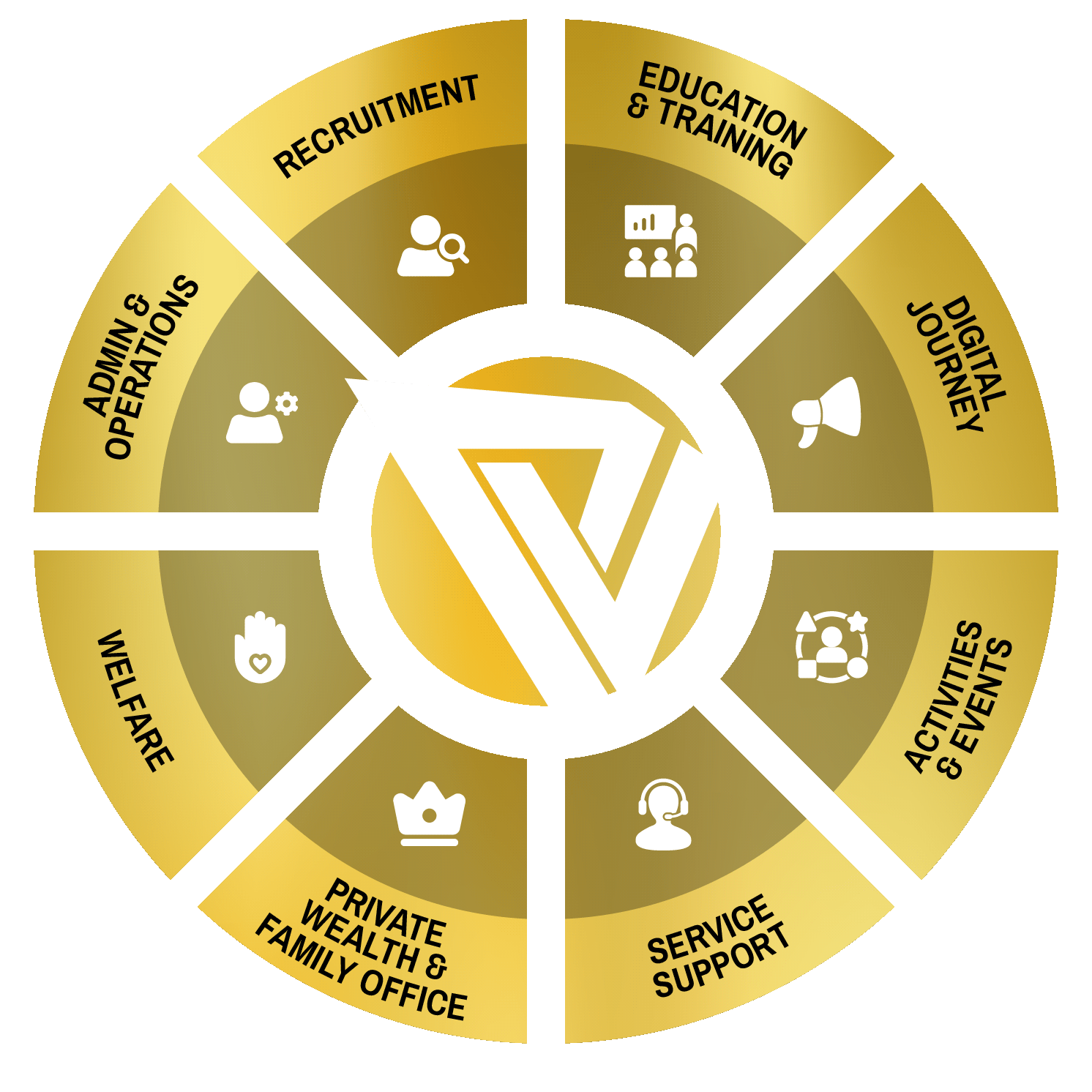

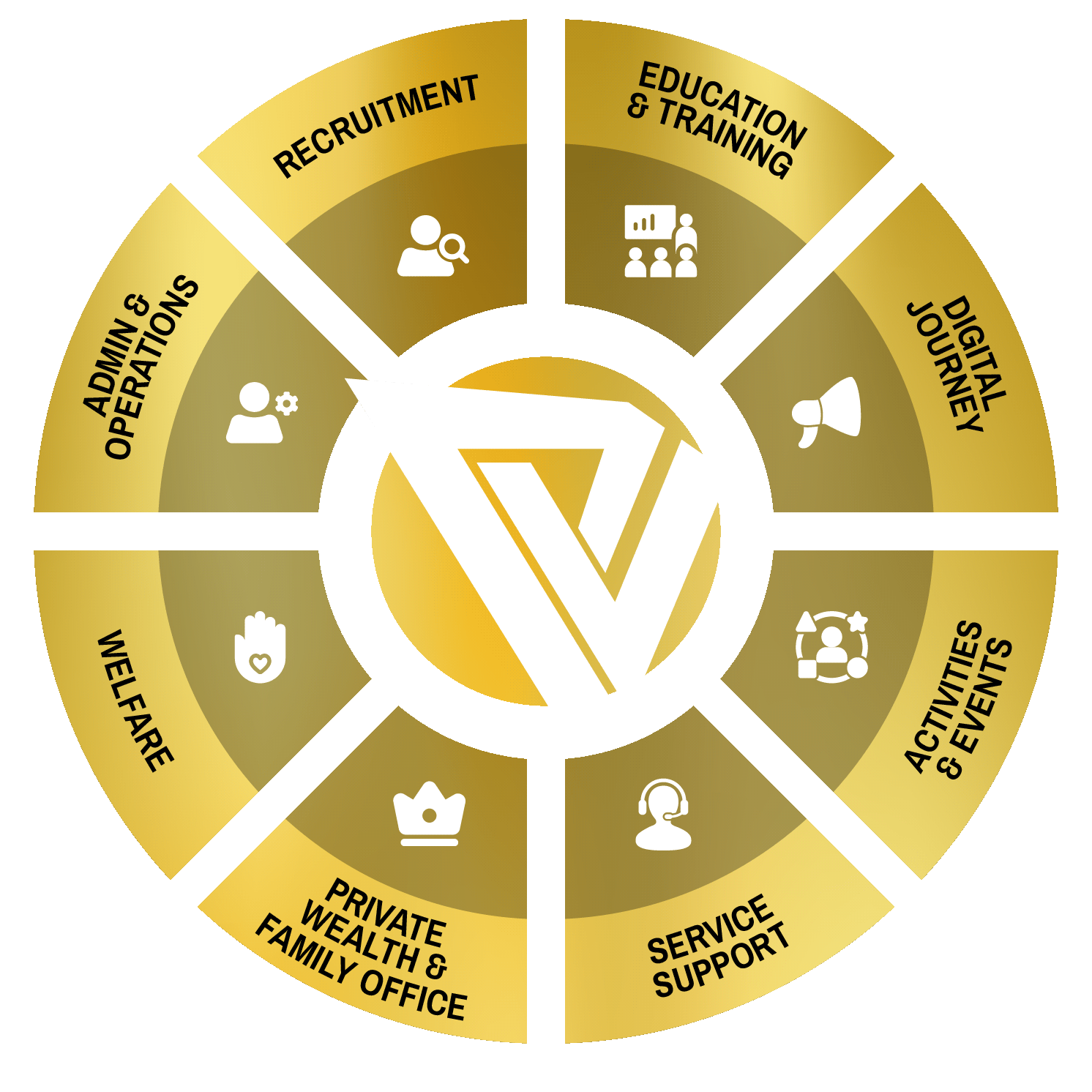

DISCOVER VISION ADVISORY’S 8 V-PULSE PLATFORMS

Responsible for creating income and career breakthroughs in over 230 consultants, with one in four making 6 and 7-figures in income.

Most financial advisory firms aspire to have multiple platforms in place to assist their consultants in income and career growth.

However, the reality is that manpower is essential to the smooth and efficient operation of each platform.

Having grown from 20 consultants in 2003 to a size of over 230 by 2023, this enables us to cherry-pick the top 43 leaders from our advisory to install and lead a solid organisational structure. This structure is critical to any career and business success.

Having both resourcefulness and the resources also ensures so nobody is stretched thin with multiple roles and everyone can still focus on their individual production.

As a result, at least 26% of Vision Advisory’s consultants have achieved MDRT and above, in contrast to the industry average of 6%, since 2021.

Source: mdrt.org

HERE’S HOW V-PULSE CAN PROPEL YOUR CAREER TO GREATER HEIGHTS

Your initial income depends on how quickly you acquire clients, but how do you still generate enough leads once you’ve covered your entire warm market?

Traditionally, financial consultants find clients through cold calling, road shows, and referrals.

Dialling uninterested stranger after uninterested stranger.

Spending hours on your feet or phone stuck to your ears.

Randomly texting people you haven’t stayed in touch with to “catch up” over coffee.

These methods have their merits but eventually, you grow tired of approaching uninterested prospects. And you only have that many connections you can “catch up” with.

What if there is a way for you to tap into a constant stream of leads that have indicated their interest in working with a professional to optimise their finances?

All these are possible because of one single weapon, a key component of V-Pulse.

This tool has generated over 9,000 leads till date, growing by an additional few hundred every month.

But that’s not all.

Come join us to discover how our digital tools also take care of your advisory process, prospect re-engagement and client servicing so that you can achieve more while working less hours.

REQUEST AN INVITATION

With high-net-worth clients, some of our consultants have tripled their income while working less and even made multiples of their past annual remuneration. But how do you even access this private and exclusive circle and win their trust?

A growing number of high-net-worth individuals and families are venturing into Singapore, so the time to capitalise on this growing market is now.

However, there’s an assumption that one has to be associated with a respectable bank to gain the trust of the ultra-rich. That is easier said than done.

As a banker, you must be assigned that particular desk to get the chance to serve this affluent group. Not every random banker in the bank gets a piece of the pie.

On the other hand, all’s fair in the game of financial advisory. In fact, most of our financial consultants who brought home 7-figure pay cheques did it through serving a small handful high net worth clients each year.

An important platform of V-Pulse empowered our consultants to forge ties with high-net-worth clients. Join us to find out how.

REQUEST AN INVITATION

Referrals and repeat business from clients are the easiest ways to grow your practice. But here are some roadblocks in your way…

If you simply wait and hope for it to happen out of the goodness of your clients’ hearts, you seldom get it.

If you seem too aggressive, it makes them hesitant to answer your calls or recommend their network to you.

Too often, you may also run out of ideas or energy to re-engage prospects and clients for the long-term.

Instead, with the V-Pulse platforms, you’ll get to…

Add meaningful value to prospects and clients.

Make your clients feel smart about recommending their network to you.

Elevate your professional status in the eyes of your prospects and clients instead of coming across as desperate or annoying.

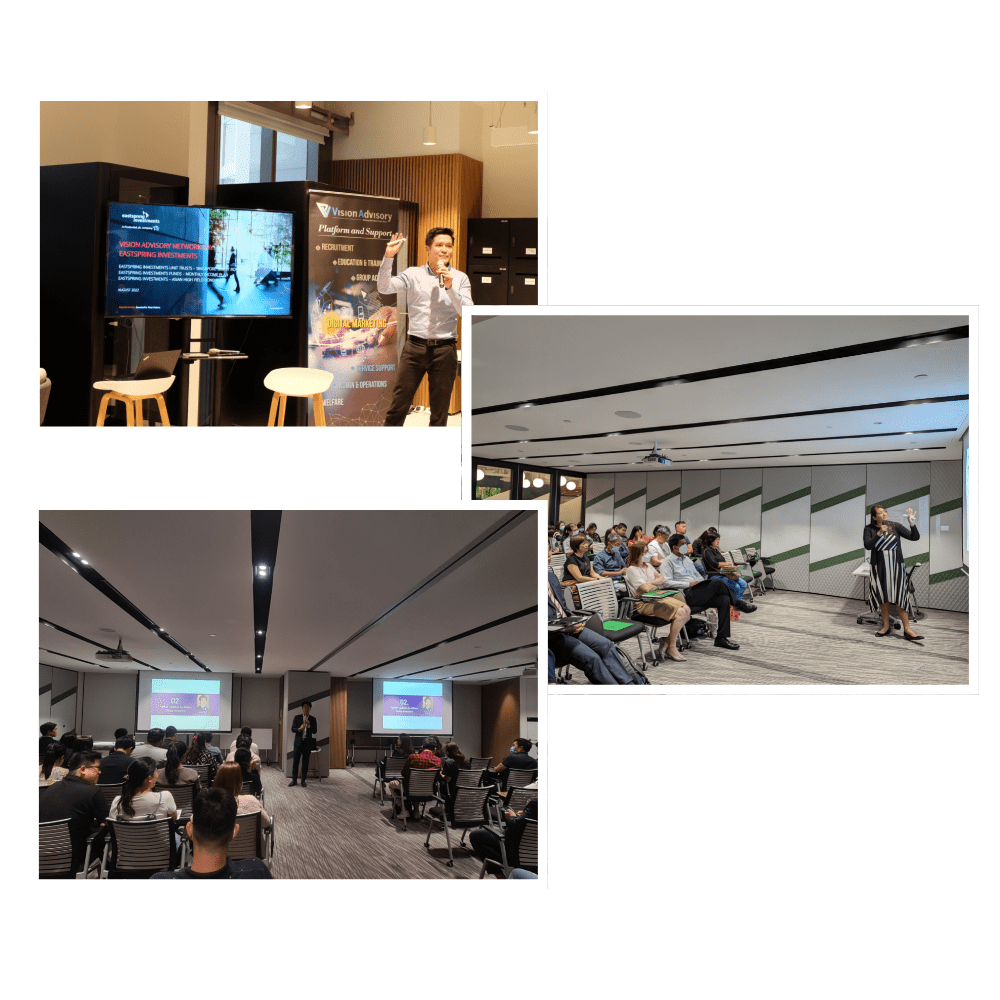

In fact, here are some pictures of prospects eagerly coming to us, the opposite of the industry norm where consultants chase after prospects.

The best part about all these is that our regular and deliberate initiatives do not take your time away from acquiring new clients.

This is thanks to our swift adoption of fintech in our client servicing. At our upcoming career networking event, you’ll get to witness a live demo.

The market has evolved. Clients today are educated and discerning. They shun salespeople and flock towards true experts and professionals.

Come to our networking event to learn how this approach has helped over 230 consultants deepen personal relationships with clients.

REQUEST AN INVITATION

In this industry, there’s something known as “The Illusion of Abundance” that causes some consultants to underperform from their 3rd year. How can you maintain your competitive edge?

I have already passed my tests, gotten my cert, and can self-learn, thought Xiao Ming. I don’t need to attend training to become a successful financial consultant, he decided.

Xiao Ming is wrong. Don’t be like Xiao Ming, because Xiao Ming is about to lose his competitive edge.

When picking a financial advisory firm to propel your career. It is important to ask yourself a few questions about their training.

Do they go beyond the basic training, theory, and product knowledge? You need more than this to grow in your career.

Is training conducted with a structured curriculum on a consistent basis? How much can you really improve if training is conducted irregularly with topics picked at random?

Does the training impart the real world experience from top producers instead of just theory and company announcements you can read about on your own?

Consumers are also more exposed to investments now. Therefore, you have to mature alongside the market. They want to be sure you know your stuff before doing business with you.

If you feel burned out or have trouble getting leads, that may be a tell-tale sign to adjust your focus.

Selling only insurance plans from a single company is no longer sustainable.

To maintain your competitive edge, you must embrace holistic planning in an organisation that provides wide access to investment products that you can promote with integrity.

Come find out more — what makes us different?

REQUEST AN INVITATION

Is menial paperwork getting in your way of closing new deals?

Running a business is not all fun and games. Sometimes you have to do the menial tasks too, even if it is at the expense of growing your business — or do you?

There’s a saying: Don’t let the little things get in the way of the big things.

You could be out there, building your network, developing strategies, growing your business. But just one overlooked detail in your paperwork can potentially delay or ruin a deal you’ve spent weeks working on.

Thanks to V-Pulse, we have a dedicated staff to dive into the details with you, so that you save yourself from having your paperwork rejected or having to go through the cycle of appealing and resubmitting.

The financial consultants of Vision Advisory can rest assured that the little details are taken care of. Speak to us to find out exactly how.

REQUEST AN INVITATION

It’s true that this industry allows you to rise up as a leader in 3 years or less. But how do you recruit, train and retain talent?

You can try to grow a team on your own.

It’s not wrong. But it might take forever without a roadmap, materials, or the correct platform.

Scenario A: You “sales-talk” your prospect into joining you.

Scenario B: You demonstrate ease of doing business together by letting them take a tour or test drive each of our platforms, and experience our events. They’ll get the chance to visualise how they’ll attract clients, their weekly operational flow, and support systems they can utilise.

In which scenario do you think you stand a better chance of recruiting your prospect?

V-Pulse will equip you to achieve Scenario B and grow your team. Come and learn how Scenario B unfolds.

Discover what V-Pulse can do for your leadership goals at our event.

REQUEST AN INVITATION

“If you have a bicycle, no matter how hard you ride, you will never outride a BMW. Platform matters.” — Tony Cheng, CEO & Founder of Vision Advisory

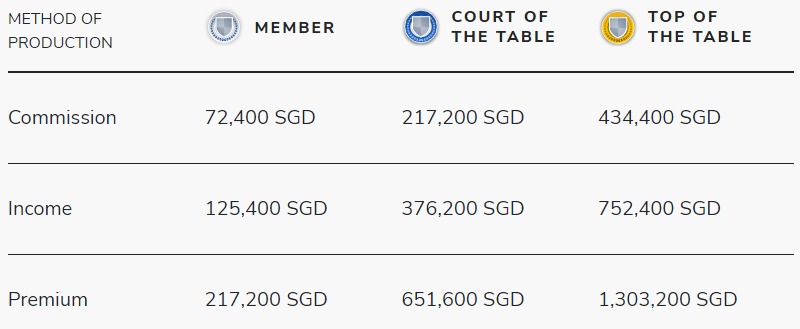

The proof of V-Pulse’s success is in our numbers.

To date, we have produced 47 MDRT, 11 COT, and 2 TOT achievers.

Come to our career networking event. Mingle with consultants who’ve used our platforms as a springboard to their success.

REQUEST AN INVITATION

SUCCESSFUL BANKER JOSEPH LEFT BANKING BECAUSE OF A CLASH IN VALUES BUT FOUND THE AUTONOMY HE SOUGHT IN VISION ADVISORY

Joseph was a high-flying banker.

He got promoted ahead of schedule, going from management associate to relationship manager to private banking, consistently performing well every year.

Which is why when he left the bank for Vision Advisory, it puzzled his peers.

But there was a reason why Joseph quit banking while he was ahead.

The remuneration system at the bank was brutal.

Hard work did not necessarily translate to high income; Joseph’s commission was determined by factors beyond his control.

For example, when a client relocated to the UK, he took his money out of the country with him. The huge withdrawal affected Joseph’s score card although the circumstances were not within his control.

That quarter, Joseph received a fraction of the commission he would have received without the withdrawal.

The frustration doesn’t end there.

The bankers answer to the bank, which dictates their choices. He struggled to balance between the client’s interest and the bank’s interest.

It was a clash of values. In Joseph’s opinion, money is replaceable but a client’s trust isn’t. Once trust is lost, it is very difficult to earn back. Joseph wanted to serve his client to the best of his abilities by handling the funds entrusted to him with utmost integrity.

Worst still, Joseph was governed by the revenue targets, which were perpetually looming over his head.

He knew that it would only get worse, because targets only got higher every year. That realisation was his turning point.

He made the switch over to Vision Advisory for the autonomy given to financial consultants.

In a financial advisory firm like Vision Advisory, the director might share their view on the products, but they don’t dictate your choices, unlike the bank.

Furthermore, the bank used to take a huge cut of the fees clients paid. Lower cuts now mean that Joseph can afford to recommend his clients the same products at better prices. It is the best of both worlds for both Joseph and his clients.

Joseph’s time at the bank translates very well into financial advisory. Thanks to their experience with portfolios, bankers usually achieve at least COT, which requires more than $700,000 of premiums a year.

But although the money is great, cash is not the reason Joseph made the jump.

As a financial consultant, he is no longer pressured to sell products he doesn’t agree with.

Instead, he has the freedom to make recommendations that best suit his clients’ needs. More importantly, through V-Pulse, Vision Advisory provides him with platforms that help him serve his clients.

That, and the extra family time, is the reason why Joseph quit banking and joined Vision Advisory while he was ahead.

Seeking a career where targets and remuneration are fair, while giving you more control at the same time? Join us at the VA Career Networking Event.

REQUEST AN INVITATION

SHERMINE LEFT THE EARLY-CHILDHOOD INDUSTRY IN SEARCH OF FINANCIAL SECURITY. VISION ADVISORY GAVE HER THE CHANCE TO MAKE MORE WHILE EMBRACING HER PASSION FOR CHILDREN

27-year-old Shermine is led by passion. She loves children.

Upon completing an advanced diploma in psychology, she joined the early childhood care and education industry. In total, she spent nearly seven years in the early childhood industry.

Then tragedy struck. Shermine’s mum developed a medical condition.

The thing about the early-childhood industry is that career progression — and by extension, income increment — comes slow. Shermine considered her situation.

She had no experience in the corporate world.

She was hardworking and poised to go over and beyond.

She knew that given her personality, sales was the way to go.

With sales, what she earned would be proportionate to the amount of value she provided.

Furthermore, the culture in the early-childhood industry was starting to weigh on her.

The long hours were one thing, but worst still, the rigidity of the system was something Shermine deplored. The lack of job satisfaction ate into her.

Shermine chanced upon Vision Advisory. Through a series of events, she decided to venture into the financial advisory industry.

The first step was to pass the professional papers required of every financial consultant.

Shermine pulled through, developing a deep sense of appreciation for the financial knowledge she gained along the way. This was knowledge everybody should have, she decided. This would be how she protected her loved ones.

To be honest, Shermine is no prodigy. She did not make exponential figures upon joining. On the contrary, her achievement is average, largely representative of the majority of consultants in the industry.

In spite of that, she experienced a notable increase from her last drawn income. Now, she can pay her bills with ease, including a helper to care for her mother.

Before that, she could conceive what having spare cash might feel like, but it didn’t land the same way it did the day she purchased an OSIM massage chair for her family without worrying about having enough money afterwards.

With financial security came better mental health. Money can’t directly buy happiness, but it soothed her anxiety by leaps and bounds.

Shermine could now bring her mother to a private hospital to see a gastroenterologist, a luxury she could not afford previously.

Medical bills were no longer a cause of anxiety the way they once were.

Much has changed since Shermine joined the workforce, but one thing remains: her unwavering passion for children. Present day, she does a lot of family planning for couples with children, including children she taught before.

Life has come full circle in Vision Advisory, where Shermine is earning enough to give her loved ones a comfortable life, while simultaneously contributing to the security and enrichment of children.

Seeking a career that rewards you based on the value you bring to others, so that you can afford the lifestyle you desire? See what we can offer at the VA Career Networking Event

REQUEST AN INVITATION

DAVID SPENT MANY CHALLENGING YEARS IN A TIED AGENCY. VISION ADVISORY OFFERED HIM THE CULTURE, PHILOSOPHIES AND SOLUTIONS HE HAD BEEN SEARCHING FOR

Upon graduating from university, David listed down what he looked for in a career.

He preferred a job that was relationship-based where he could touch lives, while having flexibility and full autonomy over his work life.

The insurance industry ticked all the boxes.

Thus, he joined a tied agency, an organisation that works exclusively with one insurer. He remained in the tied agency for close to 10 years where he has seen highs and lows.

David started out strong in his first year, but come the second year, his leads started to run dry. The tied agency was more product-oriented and he knew he did not want to be seen as a product salesperson.

He signed up for courses and invested in books. He spent his third and fourth years at the tied agency developing an appreciation for holistic planning and came up with many concepts.

In his sixth year, David started to perform well again. New consultants approached him to learn how they could also implement holistic planning. However, he hit an unexpected road block where his new ideas were not welcomed by seniors at the agency.

The misalignment of values, beliefs and philosophies became more apparent over time and he hit a ceiling.

Finally, David made a switch to Vision Advisory through the recommendation of a friend.

It was not a switch he took lightly. Prior to making the move, David approached his clients and told them that he was moving to a financial advisory firm with better diversification and dynamics. Their response was warm and met with enthusiasm.

Stepping foot into Vision Advisory opened a new world to David. The structure and philosophy was what he had strived towards all those years. The Education & Training Platform, partners and products at Vision Advisory allowed David to serve his clients in a more holistic way.

He went from feeling alone to having a sense of belonging with his peers and clients. The results soon followed.

While receiving awards was rewarding, it was the clients’ validation that gave David the most satisfaction.

One such occasion was when David accompanied his clients to an estate planning appointment. To his surprise, the clients requested for David to join in their discussion, as he was the only one who understood their finances. This made him feel that he was doing something worthwhile where he played an important role in his client’s life.

Similarly, David felt a sense of achievement when the CEO of a company acknowledged how much he had improved in his knowledge and communication skills. He was impressed with David and how far he had come, that he entrusted his assets to him. David cherished this vote of confidence.

David was able to engage with the CEO because of the training provided by Vision Advisory, provided by V-Pulse.

Now, David works closely with his wife Leanne, who has joined Vision Advisory as an consultant.

Previously, Leanne worked at multi-national corporations with back-to-back meetings, multiple assignments, countless emails and job responsibilities.

Work was intense and she could not afford to shut off or she would lose track. She felt like a cog in a machine and wanted more autonomy over her time.

Finally, Leanne decided to take the leap into financial advisory where she could have ownership over her career. From her previous roles, she shared her experience in processes that she and David incorporated into their financial advisory planning.

Like David and Leanne, the wealth of your previous career experience can translate into new strengths in the financial advisory industry. Attend our career networking event to explore how you may make a smooth transition.

REQUEST AN INVITATION

NOT ANYONE AND EVERYONE CAN BECOME A FINANCIAL CONSULTANT. FIND OUT IF YOU ARE A GOOD FIT

Having said that, the financial advisory industry is plagued with misconceptions. Let’s set the record straight about what it takes to become a successful financial consultant.

You don’t need a background in marketing or finance. Instead, what matters is attitude, ambition, and mindset.

Many of the top financial consultants first joined Vision Advisory with zero experience in marketing and finance.

Having experience in sales is a strength, but they might come with bad habits that are hard to change.

On the other hand, the inexperienced ones are like a blank piece of paper, ready to be groomed from scratch.

Justin joined the financial advisory industry with no background in marketing or finance. In fact, he has to juggle many different roles in his life.

Despite that, he has achieved notable success as a financial consultant, including getting recognised as the first runner-up rookie within the wider Manulife Financial Advisers.

This was achieved through smart time management, a good attitude, and an inner drive to succeed.

You don’t need prior sales experience to succeed as a financial consultant.

You don’t need a large social network. Instead, establish a solid relationship with existing and potential clients.

Ke Xin (not her real name) is a Singapore PR from China.

Her goal when she joined the financial advisory industry was to buy a house for her parents in China. The house she was aiming for cost about $300,000. With that in mind, she set out to acquire clients.

Naturally, since she was away from her community, she did not have a large social network when she joined Vision Advisory.

Despite that, she managed to hit COT in nine months, which required her to achieve more than $1,000,000 of premium.

Ke Xin’s key skillset is her ability to make people feel comfortable when she speaks to them.

Furthermore, her willingness to work hard, take initiative, and maintain a teachable attitude helped her become one of the top consultants at Vision Advisory.

You don’t need to come from a wealthy family. Instead, put in the hard work and you will see the results

Marcus did not come from a well-to-do background.

As a kid, money did not come easy for his family, so he knows the value of money and the importance of hard work to live a comfortable life.

Thus he put in the hours, starting out as a banker and eventually becoming a financial consultant in a competitor financial advisory firm.

Soon after, he got promoted to manager and then director.

He joined Vision Advisory for its platforms, particularly the Education and Training platform, so that his consultants can learn not just from him or their managers but also leverage on VA’s Education & Training Platform to learn from everyone else in VA through cross-learning.

He can attest that no matter if you start out rich or not, you reap what you sow.

Nonetheless, Vision Advisory has established its own unique culture that may or may not be a good fit for you.

You thrive under regimented structures

Vision Advisory’s strength is its many platforms including its education and training platform. There are mandatory training sessions on certain days of the week, conducted by the managers or external trainers.

These are experts of their respective fields who can provide you with a unique insight that self-learning cannot. We also believe you achieve the highest level of learning through interacting with peers to share your takeaways.

While you are afforded an enormous amount of flexibility at Vision Advisory, you are required to attend meetings and training sessions.

If you are unable to participate in these commitments or wish to only self-study, Vision Advisory is not a suitable place for you.

You are a team player who is willing to contribute to the overall wellness of the team even if the benefits are not direct.

Every manager is required to participate in one of the eight platforms.

Similarly, they are required to attend managerial meetings and brainstorm ideas for the betterment of the financial advisory firm, amongst other things.

While these do not bring immediate financial benefits, they contribute to the general well-being and professional development of all consultants in the organisation.

Some people work better without attachments, and there is nothing wrong with that.

However, Vision Advisory is looking for leaders who will contribute to the larger picture of the organisation.

You are willing to explore new platforms and avenues to further your career

Today, there are many new and effective avenues for growing a business.

At our event, you’ll see how we have found ways to adopt fintech and digital marketing when serving clients and building a team.

A particular method might have worked for you in the past. However, at Vision Advisory, we may choose not to utilise some of the traditional channels within the industry.

If you are open to exploring fresh methods rather than stick with doing the same thing all the time, you will find yourself aligned with our culture at Vision Advisory.

REQUEST AN INVITATION

The content above is provided by the person(s) or company mentioned. The information or service is not provided by or related to Manulife Financial Advisers Pte. Ltd.